The State of NFT Utility (February 2023)

NFTs are evolving from speculative jpegs to useful digital objects.

In the midst of a deep and dark crypto winter, green shoots are emerging.

Let’s not kid ourselves: the past 6-8 months have been challenging for the crypto/web3 markets, to put it politely. We’ve seen a wide variety of spectacles, from headline-grabbers like Terra/Luna and, lest we forget, #FTX to a cascade of contagion-related failures, project rugs, and bearish price action. On-chain volumes fell far from their all-time highs. Media sentiment became skeptical and, in some cases, outright hostile. Critics took victory laps, some of which were deserved.

The highs of the last cycle were so ebullient that the lows of this one can seem even lower. And yet, amidst the ongoing bear market, there is reason for optimism. For instance: the NFT sector, which just so happens to be our focus at Lasso Labs.

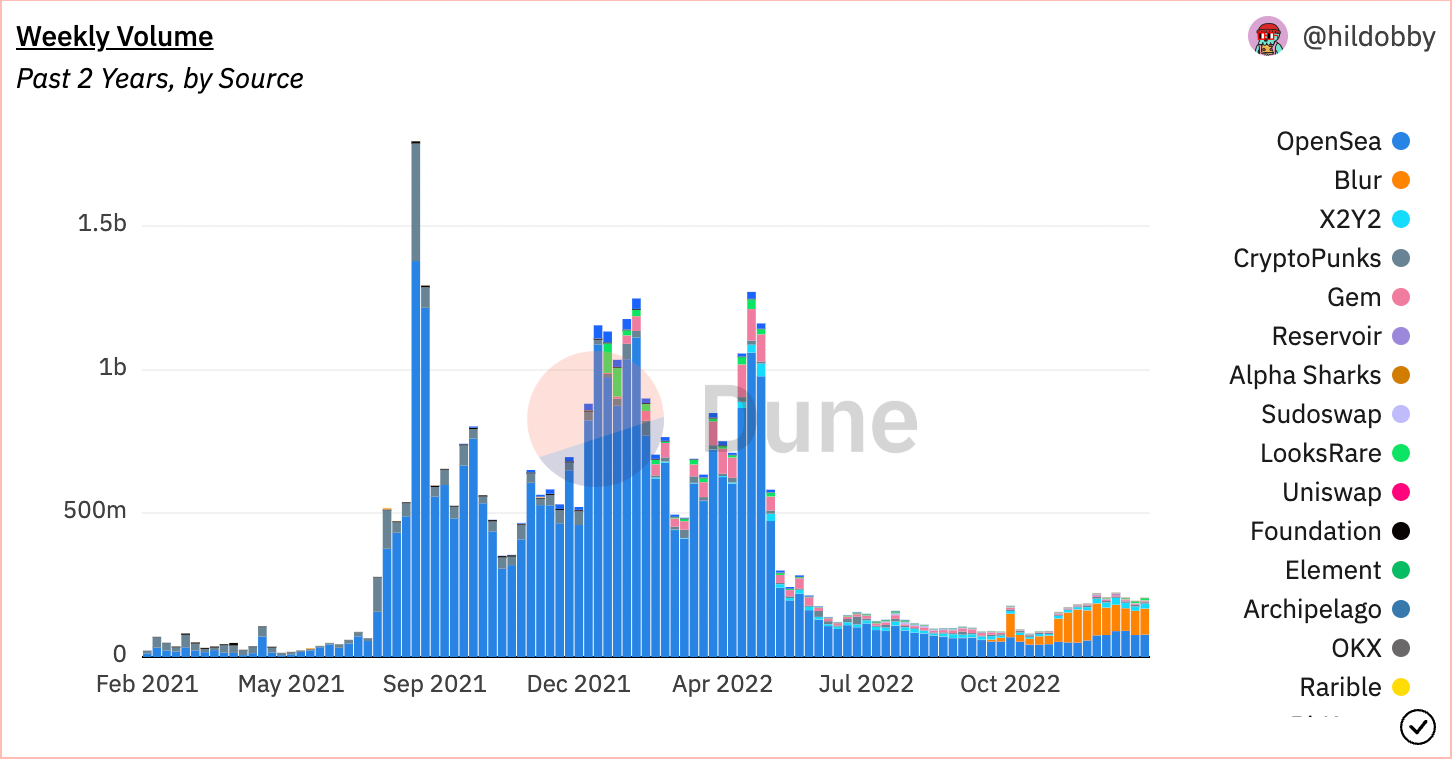

While marketplace trading volumes and associated metrics are down from the peak of NFT mania (s/o to hildobby on Dune), they’ve trended upwards again in recent weeks.

Beyond any quantitative indicator, though, sentiment amongst builders and collectors has been surprisingly resilient and positive. Projects have continued to find new and creative ways to build value for their communities, and to move from an era of pure jpeg speculation to one of useful digital objects.

This activity is important because holder expectations and market standards, in these early days, are set by bluechip collections. That’s why we're encouraged by some of the data we’re seeing in our data platform and utility registry. Today, 70% of the Top 150 Ethereum NFT collections, ranked by all-time volume in ETH, have now offered at least one token-based drop, activation, or other benefit.

70% is an impressive number in part because “utility” is a less relevant concept for some types of collections, such as generative art NFTs (see: DEAFBEEF). For those, the value is contained in the creative work alone; removing these collections paints an even clearer picture of market movement towards utility.

The growth extends even beyond household names like Bored Apes. Lasso’s data shows that ~50% of the Top 500 Ethereum NFT collections now feature utility. This is 3X growth since mid-2022, despite the aforementioned distractions and steep market decline in Q4 2022.

Our long-term thesis is that the NFT market will evolve to contain a vast range of digital assets held by an equally vast range of people, as the "NFT" acronym recedes into the distance. Think: a much higher volume of tokens, with a much lower average unit cost. Some won’t be intended for trading, but as components of identity. Others will represent real-world assets. Still others will represent loyalty or membership instruments from brands and creators. And, of course, don’t forget about on-chain media and virtual goods, such as gaming items. In this world, utility will often be implicit, not a gimmicky add-on post-minting (see: the initial days of "the utility meta" back in 2021-2022).

We already see movement towards this future-state, as today’s projects and communities innovate on the NFT primitive. We’re no longer in the world of airdrops and token-gated Discords. In fact, every single category of utility that Lasso tracks has a positive growth trajectory over the last 12 months.

Lasso's core utility types & examples:

— Lasso Labs (@lasso_labs) January 18, 2023

Access: @proof_xyz

Airdrop: @ensdomains

Events: @RugRadio & @loudpunxnft

Merch: @gmoneyNFT & @9dccxyz

Mints: @veefriends & @BoredApeYC

Virtual Goods: @MeebitsNFTs & @TheSandboxGame

Governance: @CityDAO & @shibuyaxyz

Rights: @cyberkongz

3

We’re building Lasso to make it easy for everyone to discover NFT utility, whether for tokens they already hold or projects that they’ve yet to explore. For the past few months, we’ve been in closed beta, incorporating feedback from our early users. Every week, we add more functionality and welcome new users off our waitlist. If you haven’t signed up yet, please do! We’d love to welcome you onboard.

And, as always, if you want to get in touch, feel free to DM us on Twitter or shoot us an email. Until next time...